Our Approach

Growth doesn’t just happen. It begins with the insight to recognize an opportunity, the experience and resources to cultivate it, and the commitment to realize its potential. This is why we focus on three basic steps:

SEED

Does the business have the analyses, controls, processes, reporting and systems in order to manage a dramatically different growth rate as well as improve its existing profit margin?

Does the business make capital allocation or strategic planning decisions based on analysis and reporting or emotion and instinct? Does the business have a well-defined plan and vision?

We understand that a founding entrepreneur has to weigh every business decision and capital expenditure, as a significant portion of their net worth is in the business. Our investment seeks to relieve them from any hesitations and put in place the infrastructure to prepare for the next phase of growth.

CULTIVATE

Does the business have the depth in management around the founding entrepreneur to operate a significantly larger business? What is the business’s culture and how do we preserve it?

Are the roles and responsibilities clearly defined across the organization? Are ideal people in necessary roles based on their skill set? Are incentives in place to drive their performance?

We’re well suited to craft the optimal organization based on our experience. We not only assess and support existing talent, but our reach allows us to recruit new talent from larger organizations such that they bring best practices rather than learn on the job.

FLOURISH

- …pursue larger, new customers;

- …enter new geographies;

- …introduce new services;

- …acquire competitive or complementary businesses; and

- …move from a small competitor with a history of revenue growth and operating profitability to a larger, super-regional or national player in their industry?

How We Are Different

Our commitment and goals are aligned with yours and as your partner, we’re with you every step of the way to elevate your business to new heights.

Alignment of Interests

First and foremost, we are investors and partners, not agents or managers. The Pine Tree Equity team is the largest investor in the funds; and as a result, we have a tremendous alignment of interests with founders. “Our success is your success.” A flattering compliment is that many of our prior (and current) portfolio company founders are investors alongside of us in portfolio companies unrelated to their own. Moreover, multiple founders have come to work with us again in a new portfolio company despite having achieved both financial and professional success in their own, prior portfolio company with Pine Tree Equity.

Certainty and Speed of Closing

We do not have a formal investment committee; rather, the investment professionals required to diligence, finance and document the investments work closely throughout the process. The structure allows us to proceed with certainty and speed to close; and in cases where it is possible, parallel track the work streams (instead of the more traditional linear processing of them.) The added benefit is that the impact on the business can be carefully managed and the timing of the process can be significantly compressed. Our intent is never to allow our presence to be felt or seen in the business beyond key management.

Runway for Value Creation

Given the top tier performance of the funds over time, with no losses to date, we have a fairly long runway for value creation. There is no requirement for an exit in two to four years – regardless of whether the founders’ objectives have been met – in order to show a positive statistic and raise additional funds from independent investors. This latter scenario is the “business of private equity.” On the contrary, we are focused on generating real returns in dollars, not positive statistics on paper; and we will work to deliver the real returns regardless of how arduous or long the path if we have a good partner alongside us.

Superior Returns, Consistent Track Record And No Losses

Superior Returns

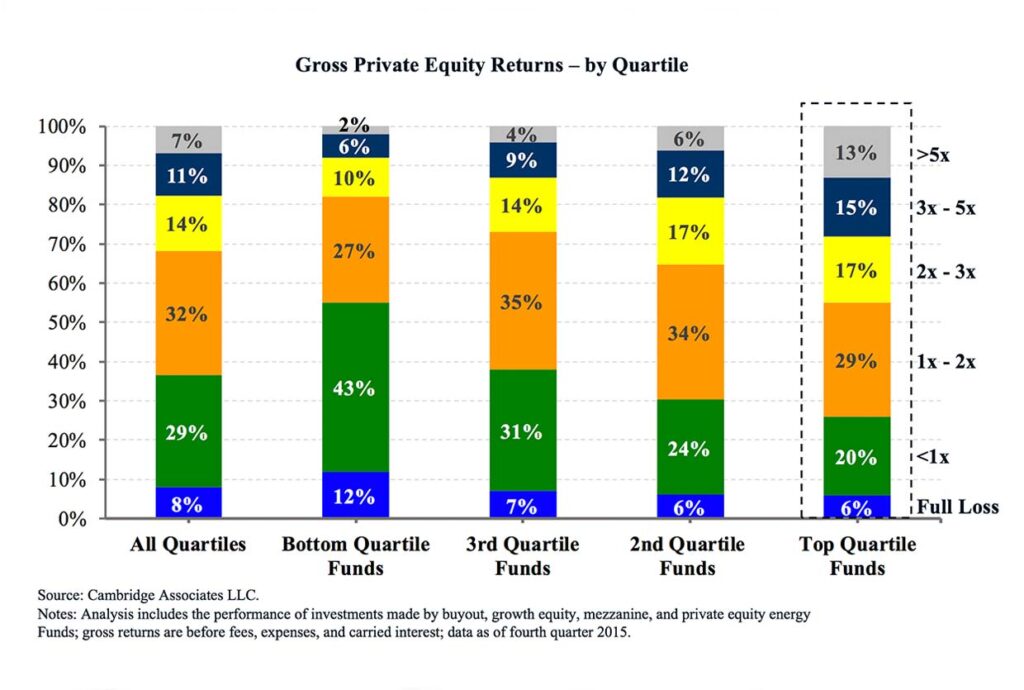

Pine Tree Equity’s returns are in the top 1% of all private equity firms, and with some 33 platform investments and 100 add on acquisitions, we have never had a loss to date despite the impact of the Great Recession. In fact, our founders have generated even greater returns than we have as a combination of both capital appreciation on their own retained equity in the business, and Pine Tree Equity’s option plans for such founders and management (where options are based on returns to Pine Tree Equity, i.e., “the higher the return to Pine Tree Equity, the more Pine Tree Equity gives back to the founder and management.”)

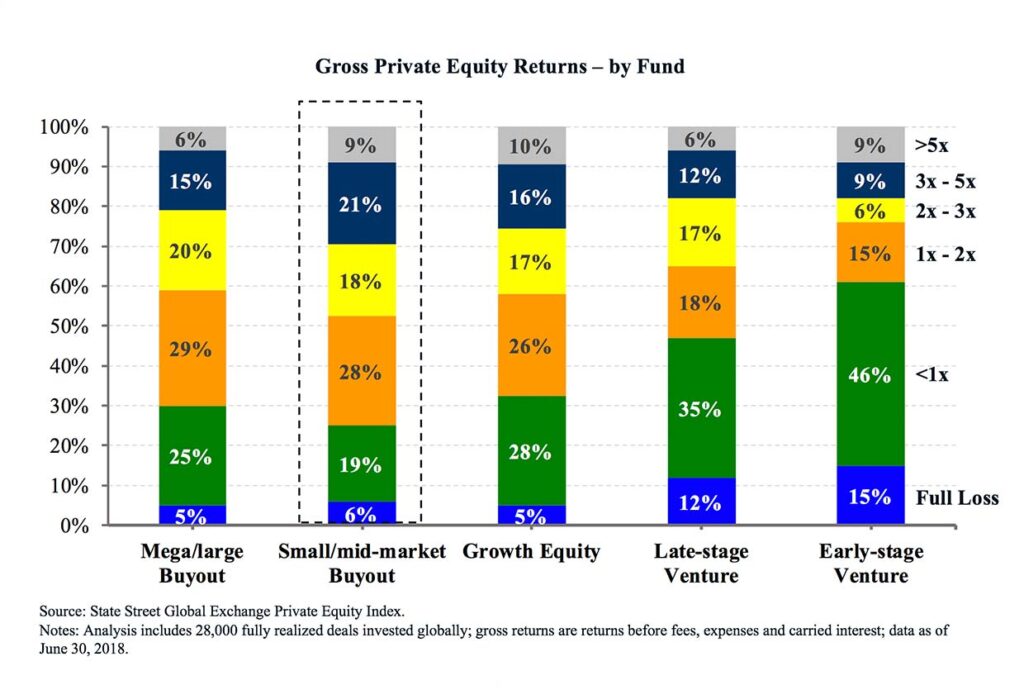

Consistent Track Record

Beyond just our absolute returns, the consistency of our returns is equally important. Small business founders should feel comfortable that a partnership with Pine Tree Equity will drive a material “second bite of the apple” and should not wonder how their retained equity in the business will fare based solely on the returns of the private equity firm because most private equity firms returns are fairly volatile. Their absolute return may be attractive, but where will the business owner be within their bell curve or distribution of returns? Private equity firms produce relatively attractive returns for their independent investors across a diversified portfolio of operating businesses just like a mutual fund manager across a diversified portfolio of public stocks, but what about the business owner? Where does the business owner fall within the % of the private equity firms’ diversified portfolio of investments that are winners, mediocre returns or losers?

Narrow Small Business Focus and Concentrated Portfolio Approach

Narrow Small Business Focus

Despite the top tier performance of the funds over time, we have not raised successively larger funds from independent investors as it would have caused us to either have moved up and out of the small business space in which we have had success to date OR expanded the team to the point where we no longer had some of the aforementioned differentiators, i.e., alignment of interests, certainty and speed of closing, or runway for value creation. Rather, we have become the largest investor in the funds and we have never changed our investment criteria – including our size criteria – since our founding in January 2007. We have been narrowly focused on the small business market, so we are NOT entering the space because we are looking “to dip our toe in the water” as a first investment or entering the space because we are looking for add-on acquisitions or an opportunity to simply deploy capital and maintain the pace of investments because larger transactions are more competitive and harder to find.

Concentrated Portfolio Approach

Billionaire investor Warren Buffett famously stated that “diversification is a protection against ignorance. It makes little sense if you know what you are doing.” In Buffett’s view, studying a limited number of industries in great depth and using that knowledge to drive profits / returns in those industries is a better value creation approach than spreading investments across a broad array of companies / sectors so that gains in companies from certain sectors offset losses from others. Pine Tree Equity has a concentrated portfolio in which, rather than making 18 to 20 investments across any given fund, we prefer to make 8 to 10 investments across any given fund. In this way, we know our businesses, and we can better focus our capital and time driving returns for a limited number of partners.

Senior Level Resources and Deliberate Focus on Every Company; Limited Diversification

Because we have a concentrated portfolio, we can deliver dedicated effort by experienced and senior professionals to each of those limited number of businesses in order to really drive scale more quickly than the entrepreneur can on his / her own. We do not have a need to focus on putting more capital to work in more investments in order to show how quickly we can invest capital for independent investors, but rather we have a need to focus on driving returns for our partners. So once we make an investment into a new business, each team will typically spend the next 12 to 18 months focusing on our three pronged approach to value creation – Seed, Cultivate, Flourish – before picking his or her head up to explore a new investment opportunity because by the time they do, the one they made 12 or 18 months prior must be well on its way toward success.

Core Focus on Service Businesses

We invest in services only: business, consumer, financial and healthcare services. Moreover, we invest in small businesses only, so we do not invest in manufacturing businesses because of the high fixed costs and we do not invest in consumer products or restaurants / retail because of the cyclicality and discretion. We expect small businesses to experience growing pains and require both significant capital and sustained patience, so we prefer to invest in service businesses that have variable costs and high margins. As a result of our core focus on small service business only, we can experience such growing pains without long lasting effects. We prefer non cyclical, non seasonal, recurring revenue businesses with EBITDA margins well in excess of 10%.

Internal Operating Partners

Our operating partners – former CFO / COO types – are internal to Pine Tree Equity and are full-time members of the team and investors in our funds, and not just independent consultants we use frequently or “friends of the family” that charge an advisory fee. They work in partnership with founding entrepreneurs where they need support but do not come with CEO backgrounds to compete with founding entrepreneurs. They are responsible for managing accounting, analysis, budgeting, controls, financing, reporting, systems as well as executing cost savings, recruiting assignments, restructurings and working capital improvements.

Partnership with Founders

Many private equity firms pay “lip service” to partnership with entrepreneurs, but we put it into practice. Of our 33 platform investments to which we have made 100 add on acquisitions, 31 of our 33 platform investments have been in partnership with the founding entrepreneur, who not only retained a meaningful stake in the business, but who also continued to be our partner in the day-to-day operations of the business all the way through our combined liquidity event. We pride ourselves in these partnerships, and recognize that founding entrepreneurs who created the businesses in which we are so excited to invest are absolutely necessary to guide the business to its next phase of growth while lending a steadying hand to its constituents. This is why we are very specific in the type of founders we work with, not only in that they are good, honest, integral people that we will enjoy working with, but also in that they are consummate professionals capable of running a $25 million revenue business as equally as a $250 million revenue business if we provide the capital, experience and support. No one said it better than billionaire entrepreneur, Morton Mandel, in that “it’s all about who.”

We think that the culture an entrepreneur has created should not be disturbed by any new investor. As a result, we confine our interaction to the key management in a small business. Our test is that if we were to call the front desk of any one of our portfolio companies and ask to speak with the founder or CEO, the person answering the call would ask ‘who are you’ and ‘what are you calling about.’ We encourage entrepreneurs to share with the broader team that they have taken capital in order to accelerate the growth of the business and create more opportunities for employees to move up and become managers with greater compensation and experience, but it’s otherwise business as usual with the exception of the scale and speed by which the company grows after our investment. We like to say that we help small business owners “step on the gas, and not turn the wheel to the right or the left.” They already have a long-standing history of revenue growth and operating profitability, albeit small, and we help them compress the time table by which they achieve their operating goals using our capital and experience, while they have significantly less risk, not to mention that we are focused on the entrepreneur maintaining his / her culture without interruption from us.

Flexibility in Structure

We make both minority and majority investments into small business. We do not have any requirement to acquire the vast majority, for example 80%, of small business. Rather, we want the entrepreneur to be very excited about their prospects for growth and reward, and our effort does not change either way.

Our Criteria

Pine Tree Equity is focused on high quality, profitable family or founder owned companies that can benefit from an active partnership with us, and where management has a meaningful financial participation going forward. Our portfolio companies exhibit the following characteristics:

-

Revenue of $10.0 million to $50.0 million.

-

EBITDA of $2.0 million to $7.0 million.

-

Growing service businesses with predictable fundamentals, including: business, consumer, financial and healthcare services only.

-

Defensible market position.

-

Predictable and stable cash flow.

-

Diversified customer base.